Clients

Implementations

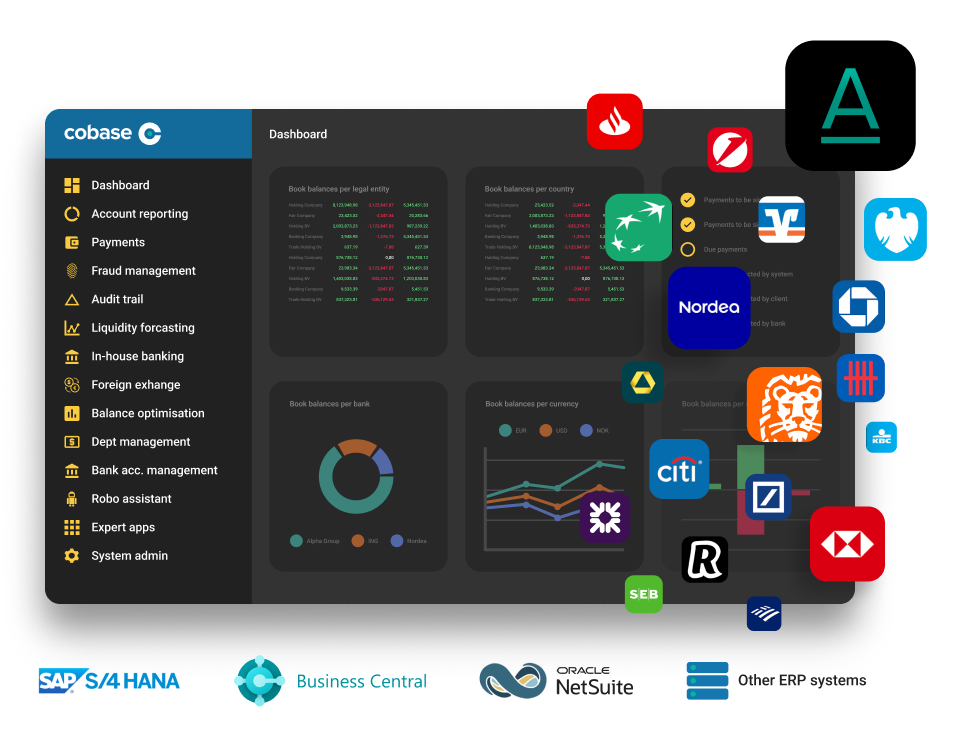

Cobase offers one of the fastest and most efficient implementation processes in the industry. Our approach is designed to minimize complexity, reduce client workload, and deliver rapid time to value. Whether you're connecting multiple banks, integrating with your ERP, and activating modules for payments, cash management, or treasury, our team ensures a structured and seamless onboarding from day one.