Clients

Private Markets

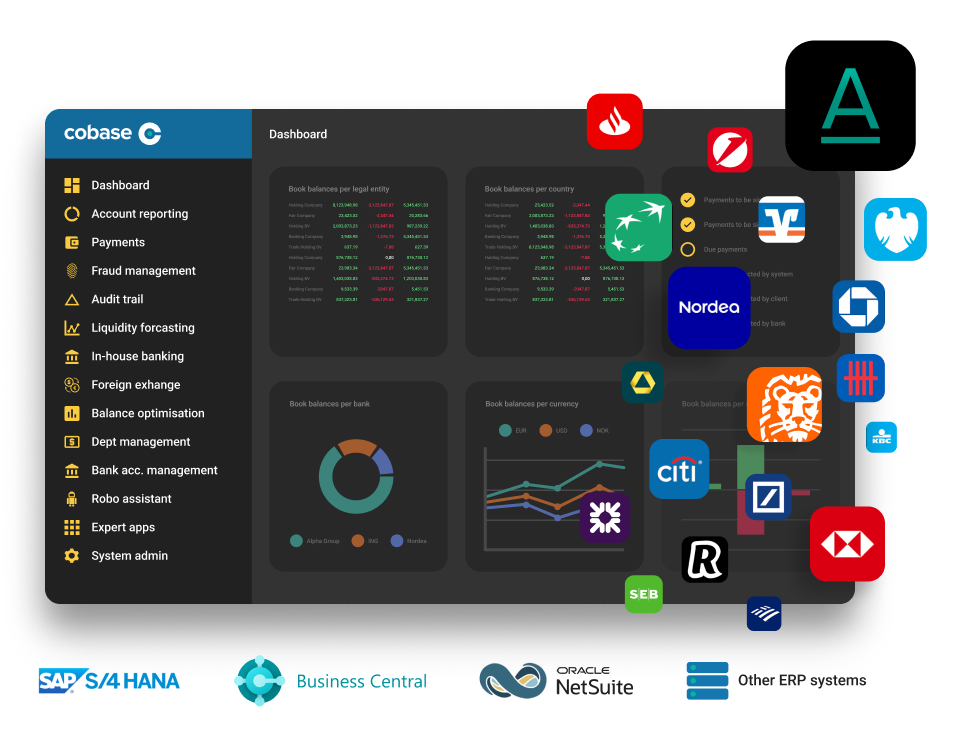

Fund administrators, trust companies, and private market service providers often face operational complexity due to fragmented bank infrastructures, manual payment processes, and strict oversight requirements. Cobase offers a single platform that brings structure, visibility, and automation to financial operations—while supporting the flexibility and security required in the private markets space.