Solutions

Explore Cobase solutions

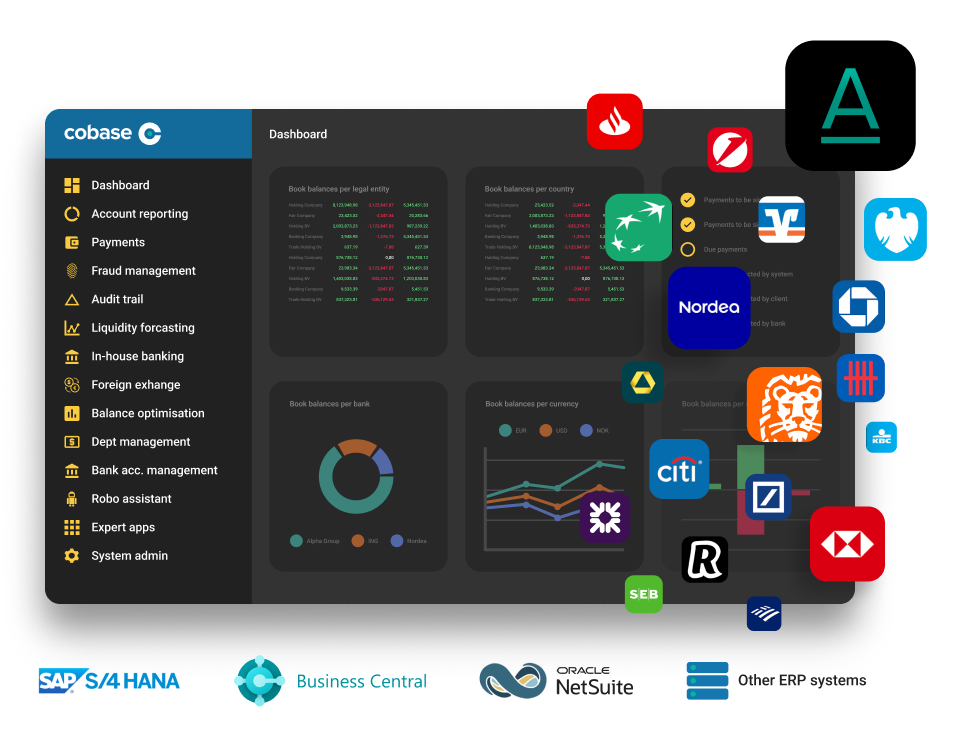

Broad connectivity to both banks, financial service providers and internal systems. It connects to banks via SWIFT, Host-to-Host (SFTP), EBICS and APIs, and supporting hundreds of banks globally.

Integrates with ERPs, accounting, and other systems to automate data flows, streamline payments, and ensure accurate reconciliation.

Real-time cash visibility across all bank accounts, enabling treasurers to monitor balances, view intraday and end-of-day statements, and generate consolidated cash position reports. The platform supports centralized liquidity oversight, helping companies optimize cash usage and improve forecasting accuracy.

Centralize payment processing across all your banks. Users can initiate, approve, and monitor payments from one platform, regardless of the bank or payment type. The solution supports bulk uploads, automated payment flows via ERP integration, and ensures full compliance with authorization policies and security standards.

Treasury modules for FX risk management, cash flow forecasting, liquidity management, cash pooling, debt and money market management, and in-house banking. These tools help centralize control, reduce risk, and improve visibility across all financial operations.

Cobase offers a modular, usage-based pricing model. Clients pay a fixed monthly fee per connected bank account. This fee includes access to the platform and core modules such as Payments and Cash Management. Optional Treasury modules can be added for an additional monthly fee.

Interested?

Manage all your bank accounts centrally with Cobase