Products

Treasury Modules

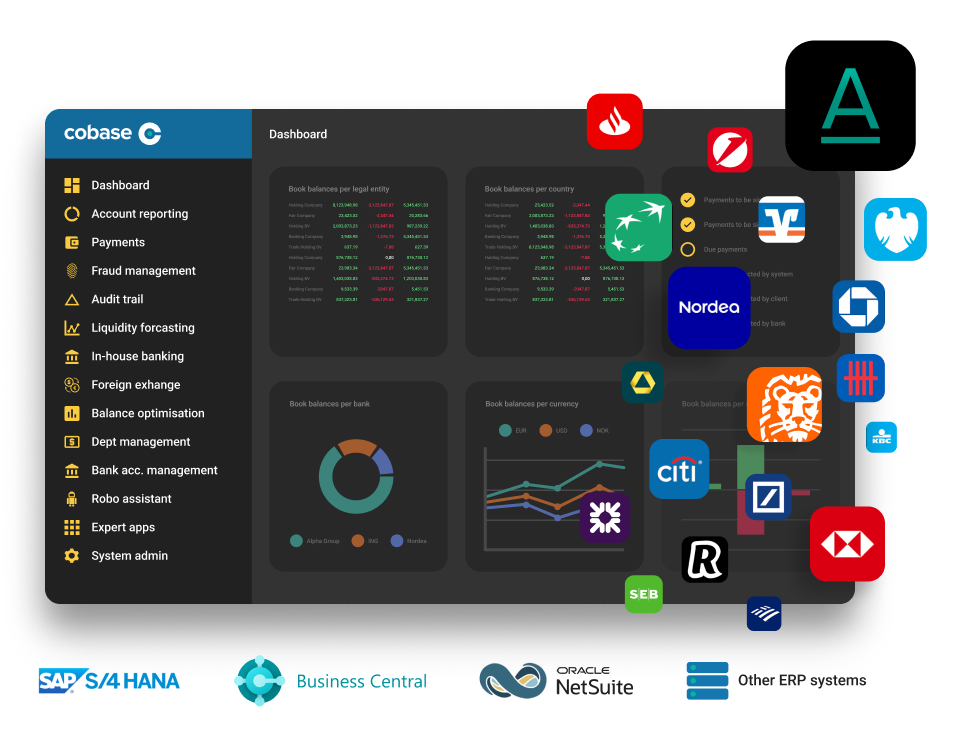

Treasury Modules designed to complement and elevate your existing Payment Hub infrastructure.

By integrating these modules, you gain direct access to powerful tools that simplify complex treasury operations, improve cash flow visibility, and enable tighter control over liquidity. Whether you need support for in-house banking, cash pooling, forecasting, or FX management, our modular approach ensures a seamless fit with your current setup — allowing your treasury team to operate with greater precision, efficiency, and strategic insight.